Jim Self noted on my post about Kris Rusch's hybrid publishing approach that what works for an author with lots and lots of books may not work so well for someone with just a few titles.

That's very true, and it's definitely something to keep in mind as you try to figure out what's going to work for you.

The thing to be aware of is that signing over your rights to a traditional publisher is actually a fairly risky proposition these days. Formerly respectable publishing stalwarts are getting into trouble, making bad decisions, and getting into even more trouble as a result. This is going to get worse, not better, over the next few years--and remember, if your publisher goes bankrupt, you don't necessarily get your rights back.

So, giving your rights to a publisher is a gamble wherein you risk the rights to your book in return for the potential reward of a larger audience. It's a gamble that may pay off, like it did for Amanda Hocking, or it may not pay off, like it didn't for Joe Konrath, or it may pay off here but not there, like it did and it didn't for Rusch.

Are any of them really hurting as a result of their gambles? No. Why not? Because they still have plenty of self-published titles out there.

What this reminds me of is how people (you know, in a perfect world) are supposed to manage their personal finances: First, you figure out what your basic living expenses are. Then you take enough money to cover three to six months of living expenses, and you put it someplace where it is both VERY safe and readily accessible. This is your emergency fund.

Now, this is not a strategy without controversy, because there are people out there who say, That's a waste! You should plow every last dime into investments with a high rate of return! You can always use your credit cards to pay for stuff in an emergency!

Of course, that last assertion is making anyone who remembers 2008/2009 laugh and laugh. Personally, I feel that the emergency fund is a good idea. I also think it's a good idea to be very hesitant to, say, quit a well-paying stable job unless you are really, really sure you'll be able to still cover your rent and pay for groceries with whatever you're going to be doing instead.

You can take risks with money that's not in your emergency fund. You can pursue your financially-risky passion in your spare time.

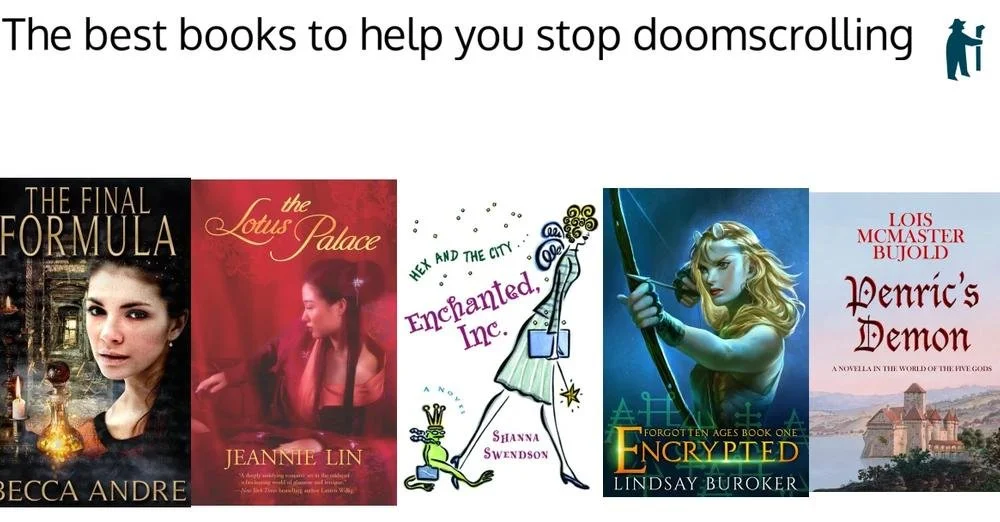

And you can gamble on traditional publishing with your "extra" books, i.e. the books that aren't generating the revenue you need to pay for your basic living expenses. Say you're Lindsay Buroker, and you're making a living--not a fortune, but a living--off your self-published books. Sensibly enough, you don't want to risk that income by signing away the rights to the majority your books. But, later on, after you've got more books and a larger income, well, maybe then you'll gamble on a couple of titles--why not? If a publisher makes them implode, you'll still be able to make a living off your core of self-published titles.

If you follow this strategy, would it ever make sense to sign away the rights to a title if that's the only book you've got? Perhaps surprisingly, I say yes. For example, you could do what John Locke did and keep the e-rights (along with that revenue stream) while signing away your paper rights (which perhaps a publisher could do more with). Or if you have a runaway hit and you're offered such a huge advance that you could invest that money and live forever off the interest, you might do that. (Just keep in mind that you could still be shortchanging yourself.)

But no matter what, you have to protect that core revenue. You have to make sure you can always get by.